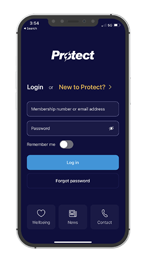

Find information for worker members - specific to the metals industry - on on this page. Download policy brochures and claim information regarding your injury cover and severance account. New members should register for online account access by generating a password via the workers portal and then download the Protect App to keep track of your account 24/7.

Forms & brochures

About Protect severance

The Protect severance brochure provides information on your account, when you can make a claim and important tax details.

![]() Download

Download

IP brochures

The AMWU Injury Cover (broken bones policy) is the brochure applicable to some metals workers. It provides detail on the benefits afforded to you when you're covered by Protect severance. Injury & illness cover is for those with income protection insurance. You may have our standard cover or the AMWU specific cover. Please check with your delegate to see which may apply to you.

![]() Download

Download

Counselling details

Download a counselling brochure for the lunch room and pop the number in your phone: 1300 725 881. Members and their families can use the confidential service for any personal or work related matter.

![]() Download

Download

Severance Claim

Members are encouraged to lodge severance claims through our phone App or online worker portal for super fast results. For further details visit our Claim page.

You can generate or rest your own password to use our online claiming tools but if you have any isuues please call our Member Services Team 1300 344 249.

Income Protection Claim Forms

Protect administers insurance products for ATC Insurance Solutions. Once your claim form is complete keep a copy and deliver the original to:

ATC Insurance Solutions

Level 4, 451 Little Bourke Street

Melbourne VIC 3000

Phone: 03 9258 1770

Freecall: 1800 994 694

Email: info@atcis.com.au

![]() Download

Download

![]() Download

Download

Frequently asked questions

Right here

Our severance and redundancy brochure is updated regularly to promote the latest regarding your Protect account. This version includes updated tax free limits and detailed advice about claiming and accessing your account online.

If you would like hard copies sent to your workplace please contact our Member Services Team via email or phone 1300 344 249.

When you separate from your employer

If you lose your job or stop work for any reason, you or your beneficiaries can make a claim from your Protect account. These reasons may include:

- Termination

- Resignation

- Redundancy*

- Promotion to an above award position, or 'off the tools'

- Retirement

- Death

If your employment ceases, severance claims can be made from your online Protect account via the yellow worker log in button on each page of our website, or from the Protect phone App, at any time of day.

* Only a payment for a genuine redundancy is eligible for the tax-free limit, all other termination event payments are taxed according to ATO rules.

The reason for leaving employment otherwise known as the 'termination event', dictates the tax applied.

*The tax free threshold for the 2024/2025 financial year is $12,524 for the initial year, and $6,264 for each full year of service with your employer.

Use the App

All severance claims can be made via:

- The Protect App or

- Your online Protect account

Claims made via these online options can be made at any time of day and are the quickest and simplest avenues for accessing your entitlements.

Need help?

Our Member Services Team can help step you through the process phone 1300 344 249 or email info@protect.net.au

You will need to complete a claim form

- Your employer confirms your redundancy

Your employer is required to confirm your redundancy details via their online Protect account however, you may proceed with your claim as soon as you have separated from your employment. - You complete a claim form

To lodge a redundancy claim, you must complete a Protect claim form. For fastest results you should do that electronically via the App or by logging in to your online account, accessible via the workers portal (yellow button) on the top right of every page of this website. - If details are missing, we follow up with your employer

If your employer hasn’t provided us with a termination date you can upload a separation certificate as confirmation of termination or Protect will contact your employer to confirm your termination. - You are paid into your nominated bank account

When your redundancy status is confirmed by the employer, you will be entitled to your funds tax free, up to your tax free threshold. Please allow 1-3 business days for the funds to appear in your nominated bank account.

It depends on your termination event

GENUINE REDUNDANCY

If you lodge a claim due to genuine redundancy, your initial claim limit is up to your tax free threshold or the balance of your account, whichever is the lesser. For the 2024/2025 financial year, the tax free threshold is $12,524 plus $6,264 for each complete year of service.

IF YOU ARE RETIRING OR LEAVING THE COUNTRY

You may claim the full balance of your account on retirement or if you are leaving Australia for more than two years.

DUE TO ANY REASON OTHER THAN REDUNDANCY, RETIREMENT or leaving australia

Where an initial claim is processed for any reason other than redundancy, for example termination or resignation, the initial claim limit is capped at $10,000 or your account balance, whichever is the lesser.

What is a subsequent claim?

After making an initial claim if you have sufficient funds, you may claim further on your account when you meet certain conditions, for example if you remain unemployed or you find employment with a non-contributing employer. You may submit a subsequent claim via the workers portal or the Protect App.

![]() Download:

Download:

Tax free redundancy payments are aligned with the age pension qualifying age

You are eligible to receive tax free redundancy claims up to your age pension age.

Claims on a Protect account due to genuine redundancy attracts a tax free component, based on your length of service with youremployer. Previously you could only benefit from this if you were under the age of 65. However, legislation has extended the age limit to match an individual’s age pension qualifying age, which means those working longer in life are no longer exempt from the tax benefits of being made redundant.

However , if you are pension age or older on the day of your dismissal, the ATO will consider the event a 'non-genuine redundancy' and you will not qualify for a tax free component.

Within 5 days

Payment will be made to your account within five business days of receiving your initial severance claim, provided your claim is accepted.

The Member Services Team

Our Member Services Team is available to answer all queries relating to your Protect account. Calling 1300 344 249 will also grant you access to our Field Officers who are able to visit you in person should you require that level of assistance.

Email: info@protect.net.au

Simply complete a transfer form

If you wish to roll an existing severance account into Protect, you need to complete a transfer form. Transfer forms are typically just one page authorisating that your balance be transferred to your Protect account. Give us a call and we can supply you with the form relevant to your exisiting fund.

Contact us

Our Member Services Team is available to answer all queries relating to your Protect account. Calling 1300 344 249 will also grant you access to our Field Officers who are able to visit you in person should you require that level of assistance.

Email: info@protect.net.au

Download IP claim forms here

Australian Claim Forms

Australian Claim Forms

- Injury and Sickness Claim Form

- Accidental Dental Injury Claim Form

- Broken Bone Claim Form

- Accidental Death Claim Form

- Funeral Benefit Claim Form

![]() New Zealand Claim Forms

New Zealand Claim Forms

For further claim information visit our Claim page

Protect administers insurance products for ATC Insurance Solutions. Once your claim form is complete keep a copy and deliver the original to:

ATC Insurance Solutions

Level 4, 451 Little Bourke Street

Melbourne VIC 3000

Phone: 03 9258 1770

Freecall: 1800 994 694

Email: info@atcis.com.au

Download a claim form

Protect administers insurance products for ATC Insurance Solutions. You can go directly to the ATC site for comprehensive information about claiming, or simply access the relevant claim form here:

-

Australian Claim Forms

Australian Claim Forms- Injury and Sickness Claim Form

- Accidental Dental Injury Claim Form

- Broken Bone Claim Form

- Accidental Death Claim Form

- Funeral Benefit Claim Form

New Zealand Claim Forms

New Zealand Claim Forms

For further claiming information vist the Claim page.

Lodge your claim form

Once completed, keep a copy and deliver the original to:

ATC Insurance Solutions

Level 4, 451 Little Bourke Street

Melbourne VIC 3000

Phone: 03 9258 1770

Freecall: 1800 994 694

Email: info@atcis.com.au

Here to help

Sections of your claim form will need to be completed by you and others by your employer or medical practitioner. If you strike a hurdle, don't be shy in giving us a call. The Protect Field Team are independent of the insurer and work with members to ensure claims progress as smoothly as possible. Officers can visit you at home, at work, or at the hospital if need be, to assist you with your claim.

(Pictured L-R) Field Officers: Steve, Brett, Joyce, Gary, Craig, John & Glenn can be contacted via our Member Services Team on 1300 344 249. You can also leave a message for any one of them through their direct contacts linked below.

The Protect Field Team

The Protect Field Team are independent of the insurer and work with members to ensure claims progress as smoothly as possible. (Pictured L-R) Field Officers: Glenn, Gary, Steve, Brett, Joyce, Craig & John can be contacted via our Member Services Team on 1300 344 249. You can also leave a message for any one of them through their direct contacts linked below.

Income protection brochures are available by industry

Copies of Protect Injury and Sickness Wording and Product Disclosure Statements (PDS) can be requested from ATC Insurance Solutions.

View contributions via the App or your online account

Contributions can be tracked via the 'contributions' tab on the Protect App (screen pictured left) or by viewing 'correspondence' on the workers portal (screen pictured right).

Answers to FAQs regarding online account and App access can be found here.

Accidental dental injury that occurs outside of work

Members with Protect's income protection insurance cover, and their dependent family members, are covered for accidental dental injuries that occur outside of work however, cover is not provided for normal maintenance of dental health. Up to four claims per family are permitted each year.

Claim forms are available at our Claim page.

What happens if I suffer a dental injury at work?

Workers compensation provides protection for work-related injuries.

For more comprehensive information on your dental cover please download your industry income protection brochure, available above or from your industry page, or speak to one of our Field Officers.

Additional benefits

Protect Extra Cover provides additional insurance benefits exclusive to financial members of the union policy holder.

These benefits may include:

- extended cover

- family ambulance cover

- increased funeral expenses

- emergency home help

- domestic assistance

- chauffeur plan

Union members should check their policy brochure to see if any of these benefits apply.

Copies of Protect Injury and Sickness Wording and Product Disclosure Statements (PDS) can be requested from ATC Insurance Solutions.

Check your policy

![]() Download

Download

Electrical, Rail & Lift

Standard Injury & Sickness Cover

Fire Rescue

Firefighter Injury & Illness Cover

Metals

Maritime

Maritime Injury & Illness Cover

Civil Construction

From the insurer

Copies of Protect Injury and Sickness Wording and Product Disclosure Statements (PDS) can be requested from ATC Insurance Solutions.

Phone 1300 725 881

Call Protect Counselling on 1300 725 881 (free call) for immediate access to our independent counselling service.

The service operates Australia-wide, 24 hours a day, 7 days a week and is available to Protect employers, workers and their immediate family, irrespective of your industry via a free phone service. Free face-to-face sessions at an independent location, as well as on-site counselling services in response to emergency situations are also available.

Yes

Protect Counselling is available to all immediate family members: 1300 725 881

Your family may also make free use of the Hunterlink online ‘Counselling Portal’ for access to self-assessment tools, information on work-related, personal and mental well-being matters.

Login with the password: Protect

Over the phone, online or in person

Counselling is provided by trained professionals and is offered over the phone, online or through face-to-face sessions (dependent on any COVID restrictions at the time). Male and female counsellors are available and this free, confidential service is available 24 hours a day, 7 days a week, accessible Australia-wide.

Face-to-face sessions can be arranged near you. Protect Counselling has access to more than 170 qualified professionals throughout Australia, including regional centres.

No referral required

You do not need a referral to access Protect counselling. There is no wait time and every call is answered by a professional counsellor.

Counselling portal

Members can access the Hunterlink online ‘Counselling Portal’ for access to self-assessment tools, information on work-related, personal and mental well-being matters.

Login with the password: Protect

Please note - the portal is part of Protect’s overall counselling service offering, however we strongly encourage you to call 1300 725 881 (free call) as your first priority.

![]() Download

Download

Dealing with a pandemic

Hunterlink resources related to the COVID-19 pandemic:

![]() Download

Download

- Help with anxiety

- Mindest shift during pandemic

- Working from home

- Managing a team working from home

- The discomfort you are feeling is grief

Protect benefits have been negotiated into your workplace agreement

Your employer has registered you with Protect because they are paying severance contributions and/or income protection insurance premiums to us on your behalf. The amounts paid will be in accordance with the terms of the industrial agreement that determines your pay and conditions, such as your enterprise bargaining agreement.

Severance or income protection contribution amounts differ for Protect members working under different agreements. You can contact your employer to access your agreement, or search via the Fair Work Commission website.

Only people registered by a Protect contributing employer can become worker members of Protect.

Expect a welcome pack and access to your membership card

Once your employer registers you with Protect, you will receive a welcome message with your membership number and information regarding the Protect services available to you. You may be eligible for a severance account, income protection or both. All members have access to free counselling.

Do I have to do anything?

1. Download the Protect App:

The ‘Protect Services’ App is available for download from the App Store or Google Play. The App lets you:

- Review employer contributions

- Check your current account balance

- Lodge a severance claim

- Access income protection claim forms

- View your membership card

- Change your password or contact details

- Contact us

2. Activate your account:

Using the membership number emailed to you and the contact details we have recorded on our database, you may activate your online account using either the Protect App or our website workers login portal

- Select 'new to Protect' on the App or ‘register for online access’ at the portal

- Verify your contact details and set a password so that you may then log in to manage your account. Note that the log in you create will work for both the App and portal.

Please note: unless we have your correct contact details, the generate password feature will not be useful to you. If you have any difficulty please call us on 1300 344 249.

Sometimes, but you'll need to check

Agreements that include income protection for non-apprentices will usually also include it for apprentices. Entitlement to severance contributions however, depends on your workplace agreement. In the electrical contracting industry, for example, it's usually only after completing your apprenticeship that you are entitled to receive severance payments.

Please check with your union or give us a call to determine your eligibility. Contact our Member Services Team on 1300 344 249 or via info@protect.net.au

The log in area for worker members

Account management features available to you via the Protect Services App are also available online. Log in to the worker's portal using the yellow button available at the top right of every page of this website.

USE the App:

- Download the Protect Services App

Australian links: App Store and Google Play

New Zealnad link: App Store - Select ‘new to Protect’

Follow the prompts to verify your contact details and set yourself a password.

Two factor authentication (2FA) is enabled. The App will send you a unique one-time passcode via text message to complete login. 2FA will then be required for all future App access. Facial recognition is also enabled and will avoid repeated password entry requirements.

or... USE the workers portal:

- Jump online

Once you have been provided your membership number, new members should visit the workers portal, accessible via the yellow worker login button on every page of this website.

- Select ‘Register for online access’

Follow the prompts to verify your contact details and set yourself a password. Please allow up to ten minutes for your password to be registered on our system. You may then log in to manage your account.

What if I have already had access and have forgotten my password?

Both the App and workers portal have a ‘forgotten password’ feature that you can use to reset your access at your convenience.

How many passwordS will I need?

Just one. Once you have set yourself a new password, your login details will work for both the App and workers portal.

Why can't I generate a password?

Unless we have your correct date of birth and contact details including email address and mobile number, the generate password feature will not be useful to you. If you have any difficulty please call us on 1300 344 249.

Select the link to reset your password

You can use the 'forgotten password' feature on the App or via the workers portal to reset your password.

- Select the 'forgot password' link.

- Enter your membership number or the email address we have on file for you.

- For security purposes you will be sent a verification code if using the App. Enter the code when directed and you may then reset your password. If you're using the workers portal you will be sent a link to complete the update process.

Having trouble?

If you don't know your membership number, or we do not have your correct contact details, you will not be able to make use of the 'forgot password' feature on either the Protect App or workers portal. Instead, please email or use the 'contact us form' to request access to your online account.

The Protect App

The online workers portal

Features available to you via the App are also available online. Log in to the worker's portal using the yellow button available at the top right of every page of this website.

It's a handy tool for worker members

The App is a tool to assist workers manage their Protect account. It's especially handy for those with a severance account, you can lodge a claim in seconds using the App.

- Check your account balance

- Display your membership card

- Track employer contributions, paid or outstanding

- Lodge a severance claim

- Access IP claim forms

- View your severance claims history

- Update your account password or contact details

- Contact us or check the latest Protect news

Once your have been registered as Protect member and provided a membership number, you may use the App to generate a password and start using our online services. Simply select the 'new to Protect' link and follow the prompts.

![]() Download the Aussie Protect App:

Download the Aussie Protect App:

![]() Download the New Zealand Protect App:

Download the New Zealand Protect App:

The AMWU and Protect proudly work together to provide a top notch injury cover for AMWU members across several metal trade industries to assist members and their families in difficult and unforeseen times.

This is a valuable benefit for our members which we will continue to maintain and seek to improve

Tony Mavromatis

Secretary

AU & NZ Counselling Phone Numbers

Protect counselling is a free confidential service for individuals seeking support, as well as employers and workers wanting advice on the best method to assist colleagues dealing with a range of concerns:

For further support contact

Protect member services team

1300 344 249

info@protect.net.au

Field Team & Industry

Liaison Manager

Gary Robb

0458 602 155 AU

(04) 280 6608 NZ

grobb@protect.net.au